Dating payment gateway systems guide 2025: Choosing the best for your dating platform – PG Dating Pro

Choosing the right payment system and obtaining a dating merchant account is crucial for your dating platform’s success. Specialized payment services and payment service providers offer tailored solutions for online dating platforms, bringing expertise in secure, high-risk transaction processing, fraud management, and compliance. This comprehensive guide covers all payment options available in 2025, including systems integrated with Dating Pro platform and additional payment gateways you can connect.

Business Requirements

- Can start as an individual entrepreneur

- Register business after generating income with Dating Pro Payment processor

- Business license requirements vary by region

- Payment gateways may require the business owner to submit identification documents, such as a driver’s license, during the KYC process to verify legal identity and comply with regulations

- Insurance recommended for service providers

- Revenue model: 100% belongs to platform owner

- A valid bank account is necessary for settling funds from credit and debit card transactions

Web payment systems

Level 1: The following payment gateways are included in the Dating Pro platform:

These gateways enable dating platforms to securely accept payments from users globally. They can also seamlessly integrate with the Dating Pro platform, ensuring a smooth payment experience for both users and administrators.

| Payment system | Setup fee | Monthly fee | Transaction fee | Adult content | Region coverage |

|---|---|---|---|---|---|

| PayPal | Free + Requires approval * Available globally, but not in countries under sanctions. |

Free | 2.9% + $0.30 | Requires approval | Global |

| 2Checkout | Free + Insurance deposit * Available in 180+ countries, some restrictions may apply. |

Free | 3.5% + $0.35 | Yes | 180+ countries |

| CCBill | Free + Insurance deposit *Available in 197 countries, with some country restrictions. |

$10-50 | 5% + $0.25 | Yes | 197 countries |

| Authorize.net | $25 + Requires approval *Available in US, UK, CA, requires approval for others. |

$25-35 | 2.9% + $0.30 | Requires approval | US, UK, CA |

| Verotel | $49 + Insurance deposit *Available globally, some restrictions may apply. |

$19-49 | 5-7% | Yes | Global |

| Securion Pay | Free + Insurance deposit *Available in 40+ countries, restrictions may apply. |

From $19 | 2.9% + $0.30 | Yes | 40+ countries |

| Skrill | Free + Requires approval *Available in most countries, restrictions in sanctioned countries. |

From $1 | 2.99% + $0.29 | Requires approval | Global |

| Robokassa | Free + Requires approval *Available in RU, CIS, some restrictions for others. |

$5-20 | 2.5-10% | Case by case | RU, CIS |

| Dating Pro payment processor Optional feature in Dating Pro platform |

Free + Requires approval *Available globally, with country-specific legal requirements. |

Free | 15% | Yes | Global |

These gateways enable dating platforms to securely accept payments from users globally.

Level 2: Other payment systems that can be integrated with Dating Pro platform

| Payment system | Best for | Setup fee | Monthly fee | Transaction fee | Adult content |

|---|---|---|---|---|---|

| PayKings | High-risk | Free | $50 | 4.9% + $0.30 | Yes |

| Payment Cloud | Adult content | $99 | $19 | 3.9% + $0.30 | Yes |

| Ikajo | Global coverage | Custom | $50-100 | 4-5% | Yes |

| Payop | New projects | Free | $10-50 | 3-5% | Yes |

| Payssion | Global reach | Free | $5-30 | 3.9% + $0.30 | Yes |

| PayspaceLV | European focus | Custom | $10-50 | 4-5% | Yes |

| Fonix | UK market | $50 | $25 | 3-4% | Yes |

| Centralpay | European focus | $50 | $20-50 | 3-5% | Yes |

Important notes

- Integration cost: Adding new payment systems typically costs $69-$990 for custom integration work.

- Some systems may require additional security deposits

- Adult content support often requires additional verification

- Regional availability may change based on regulations

- All fees and rates are subject to negotiation for higher volumes

- The application process for integrating new payment systems is usually straightforward and requires basic documentation. However, always check for hidden fees that may not be immediately disclosed. Once your account is approved, you can start processing payments quickly.

Level 3: Regional coverage and recommendations

The choice of payment system and the setup process can depend on several factors, such as provider selection, integration complexity, and whether your business falls into a high risk category. For example, online dating platforms are often considered a high risk category, which can lead to increased scrutiny from payment processors and acquirers. Some payment systems are specifically designed to support businesses in this category.

| Payment system | Setup fee | Monthly fee | Transaction fee | Adult content | Best for |

|---|---|---|---|---|---|

| Fortumo | From $0 | $20 | 5-15% | Yes | Mobile payments |

| M-Pesa | Custom | N/A | 1-2% | No | African markets |

| Corefy | Custom | $20-100 | 1-3% | Yes | Multi-processing |

| FasterPay | Free | $5-15 | 3.5-5% | Yes | Global coverage |

| Borderless Payments | $50 | $30 | 3.5-5% | Yes | International |

| Corepay | Custom | $10-50 | 3-5% | Yes | High-risk |

| AdvCash | Free | $5-15 | 0.5-3% | Yes | Crypto-friendly |

| Connectum | Custom | $10-50 | 3-5% | Yes | European focus |

| Leappayments | Custom | $20-50 | 3-5% | Yes | Global coverage |

| Total Processing | Free | $10-40 | 2.9% + $0.20 | Yes | Enterprise |

| Readies | Custom | $10-50 | 3-4% | Yes | Custom solutions |

Best practices by business stage

Starting out

- Use Dating Pro payment processor initially

- Add PayPal for global reach

- Consider CCBill for adult content

Growing business

- Add regional payment systems

- Implement multiple processors

- Optimize for conversion

- Consider obtaining an online dating merchant account or a dating site merchant account to manage payment processing effectively, support subscription payments, and reduce the risk of chargebacks.

- Implement subscription billing to enable recurring payments and ensure steady revenue from memberships.

Worldwide level

- Direct integrations

- Custom payment flows

- Multiple backup systems

Mobile payments

| App Store | Base Commission | Additional costs | Geographic coverage | Adult content support | |

|---|---|---|---|---|---|

| Google Play | 30% | $25 one-time developer fee | Global | Limited, requires approval | |

| Apple App Store | 30% | $99/year developer account | Global | Limited, strict guidelines | |

| Huawei AppGallery | 0-30% | Free registration | Global (focus on Asia) | Case by case | |

| Samsung Galaxy Store | 15-30% | Free registration | Global | Case by case |

Payment integration is especially important for dating apps, as these platforms face unique challenges related to security, compliance, and credit card acceptance. Dating apps are often considered high-risk, so choosing the right payment gateway and understanding merchant account requirements is crucial for smooth operation and user trust.

Key integration points

| Integration step | Google Play | Apple App Store | Huawei | Samsung |

|---|---|---|---|---|

| Account setup time | 1-2 days | 2-5 days | 1-3 days | 1-3 days |

| Review process | 3-7 days | 1-2 weeks | 3-5 days | 3-5 days |

| Payment integration | Built-in | Built-in | API required | API required |

| Testing requirements | Internal + Beta | TestFlight | Beta testing | QA testing |

Pro Tips:

- Regional considerations

- Huawei for Asian markets

- Google Play & Apple primary for Western markets

- Samsung for global reach

- Compliance requirements

- Content guidelines vary by store

- Payment regulations by region

- Adult content restrictions

Transaction Security

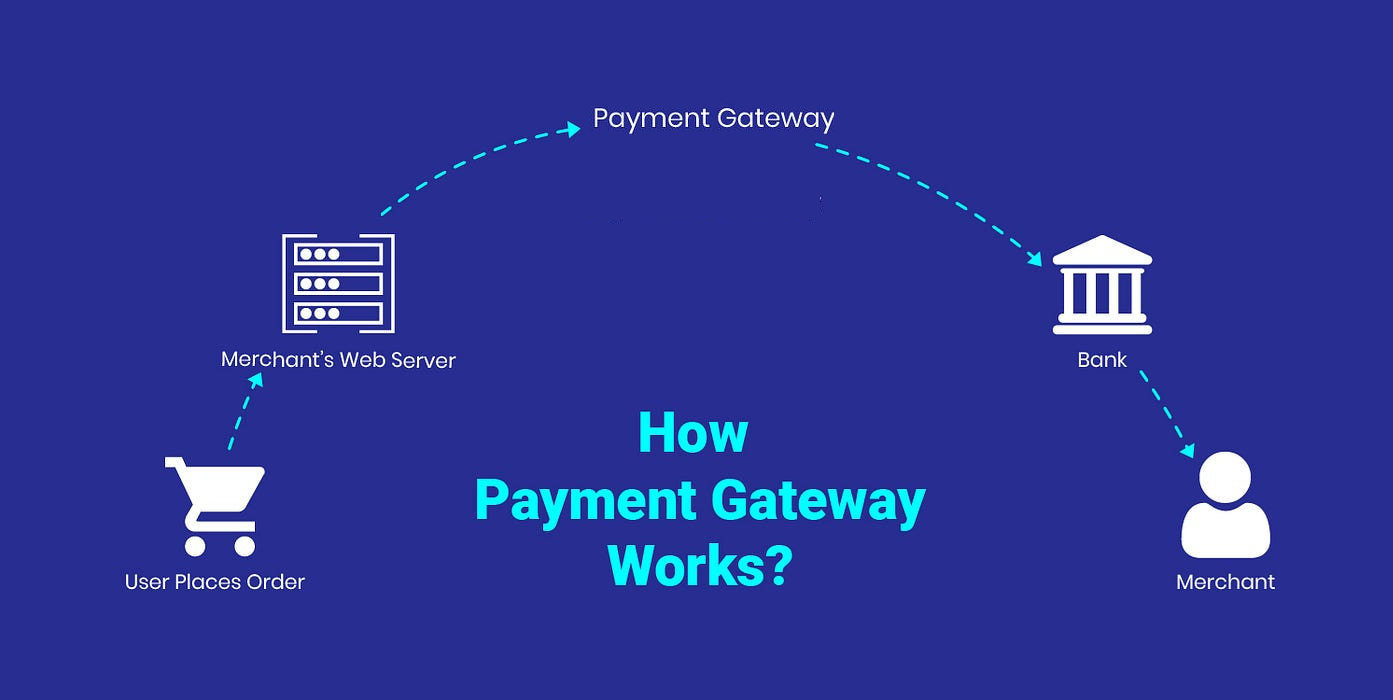

Transaction security is a cornerstone of success for online dating businesses, directly influencing customer satisfaction and long-term trust. In the online dating industry, where platforms are often considered high risk, ensuring secure transactions is not just a best practice—it’s a necessity. Online dating merchants must prioritize robust security measures to protect sensitive user data and maintain a safe environment for all transactions.

To achieve a secure payment experience, online dating payment processing should leverage advanced encryption technologies and comprehensive fraud detection systems. Payment gateways that support online dating businesses—such as Fibonatix, PaymentCloud, and others—offer secure processing for credit and debit cards, as well as digital wallets like Google Pay and Apple Pay. These payment options provide flexibility for users while ensuring that their financial information is protected.

Implementing payment processing solutions such as tokenization and 3D Secure adds an extra layer of defense against fraudulent transactions and chargebacks. Tokenization replaces sensitive card data with unique tokens, reducing the risk of data breaches, while 3D Secure authenticates cardholders during online payments, minimizing unauthorized transactions. For dating merchants, these tools are essential for maintaining smooth operations and building customer confidence.

Compliance with industry standards, particularly PCI DSS, is critical for all online dating merchants. Adhering to these standards not only helps prevent data breaches but also demonstrates a commitment to secure transactions and industry best practices. Partnering with reputable payment providers ensures that your dating platform remains compliant and up-to-date with evolving security requirements.

In summary, transaction security is vital for any online dating business aiming to accept payments, reduce fraudulent activity, and foster customer loyalty. By investing in secure payment gateways, adopting advanced payment processing solutions, and ensuring compliance with industry standards, online dating platforms can deliver a safe and seamless payment experience that supports business growth and customer satisfaction.

Common mistakes to avoid in online dating payment processing

Navigating the complexities of online dating payment processing can be challenging, especially given the high-risk nature of the industry. Dating sites and dating websites are considered high risk industries due to the prevalence of fraud, chargebacks, and regulatory scrutiny. To ensure a smooth and secure payment experience for your customers, it’s crucial to avoid common pitfalls, particularly when handling credit card processing and card not present transactions. Here are some key mistakes to steer clear of:

- Not choosing a high-risk merchant account provider: Online dating businesses, including dating sites and dating websites, are classified as high-risk, necessitating a merchant account provider experienced in handling high-risk accounts and dating accounts. Opting for a provider without this expertise can result in account shutdowns and financial setbacks.

- Neglecting robust fraud prevention measures: The online dating industry is particularly susceptible to fraud and chargebacks, especially with card not present transactions that are common on dating platforms. Implementing robust fraud prevention measures such as 3D Secure, CVV checks, and AVS checks is essential to mitigate these risks and ensure compliance with industry standards.

- Lack of clear and transparent payment terms: Clearly communicate your payment terms, including details on recurring payments, subscription fees, and refund policies. Transparency helps prevent customer disputes and chargebacks, which are frequent issues for dating websites.

- Non-compliance with industry regulations: Adherence to industry regulations like PCI DSS and GDPR is non-negotiable for dating sites and dating accounts. Non-compliance can lead to hefty fines and penalties, so ensure your credit card processing practices meet these standards to ensure compliance.

- Inadequate monitoring of payment processing activity: Regularly monitor your payment processing activity to detect and prevent fraud, and to identify and resolve any technical issues that may arise, especially for dating website transactions.

- Limited payment options: Offering multiple payment options, such as credit and debit cards, PayPal, and mobile payments, caters to diverse customer preferences and can boost conversion rates for dating sites.

- Failure to optimize payment pages for mobile devices: With a growing number of users accessing online dating services via mobile devices, optimizing your payment pages for mobile is crucial for a seamless user experience.

- Insecure payment gateways: Ensure your payment gateways are secure, employing encryption and other security measures to protect customer payment information, particularly for card not present transactions on dating websites.

- Not testing payment processing systems: Regular testing of your payment processing systems is vital to ensure they function correctly and to address any technical issues promptly, which is especially important for high-risk industries like dating sites.

- Lack of customer support: Providing robust customer support for payment-related issues is essential. It helps resolve disputes and complaints efficiently, enhancing customer satisfaction for dating accounts.

By avoiding these common mistakes, online dating merchants can ensure a secure and efficient credit card processing experience, reduce the risk of fraud and chargebacks, ensure compliance with regulations, and ultimately increase conversion rates and revenue for their dating websites.

FAQ

How to find PayPal Merchant/Seller ID

In your PayPal account, go to your Business information section – https://www.paypal.com/businessprofile/settings/

and copy the value in the Seller account ID field.

Would I need a business license to operate this in the US? Do I need insurance to provide this service to my clients?

Our clients typically test their business model by launching their dating service first. After receiving their initial confirmed payments, they then proceed with formal registration. This approach is faster and more cost-effective.

This is just general information and is not legal advice. You should consult with an attorney and an insurance agent to get specific advice for your situation.

Yes, you will need a business license to operate Dating Pro in the US. The exact requirements will vary depending on your state and city, but in general, you will need to obtain a general business license. You may also need to obtain additional licenses or permits, depending on the specific services you offer.

Yes, it is recommended that you have insurance if you are providing Dating Pro platform to your clients. This will help protect you from potential lawsuits that may arise as a result of your clients using your software.

Our clients usually test their business model by launching their dating service first. After receiving initial confirmed payments, they proceed with formal registration. This approach is faster and more cost-effective.

In order to add payment packages to your native android app, you will need:

1. Go to https://console.developers.google.com/apis/library? and check that all api are activated https://i.imgur.com/eVgWho2.jpg

2. Go to credentials and generate an api key (for web application) and oauth client (for web application) https://i.imgur.com/gD1gDT0.jpg

3. Copy this data to admin panel -> modules -> mobile -> In-app Billing settings https://i.imgur.com/oI9Clp0.jpg

4. Go to Google Play console (https://play.google.com/apps/publish/) then choose your app. In the left menu go to Store presence -> In -app products (you may need to set up your google merchant account if you don’t have one). Then add packages you want your users to see https://i.imgur.com/bhstveV.jpg

5. Copy the data to admin panel -> modules -> mobile -> in-app billing settings -> purchase tab https://i.imgur.com/JXjIiHJ.jpg

The PayPal recurring payments add-on at $99. Once I purchase it, it will be add to my PayPal setup section in the admin section?

You do not need to purchase the PayPal integration as it is already included in the Pro plan.

What might payment providers request during integration, and how much does it cost?

Payment providers — especially those working with high-risk categories like dating — often request minor adjustments to ensure your platform complies with their policies. Typical requests may include:

- Disabling the “Send Money” option on user profiles

- Removing adult-related settings or toggles from profile pages

- Making sure external links open in a new tab (

target="_blank") - Preventing users from renewing a subscription before the current one expires

- Minor interface or settings adjustments to clarify permissions or user flows

These are common and expected, particularly with providers like CCBill. Most changes take 10–30 minutes to apply and are handled by our Professional Services team. Costs start from $20, depending on the scope.