Scaling Your Dating Business Through Investments: The Basics

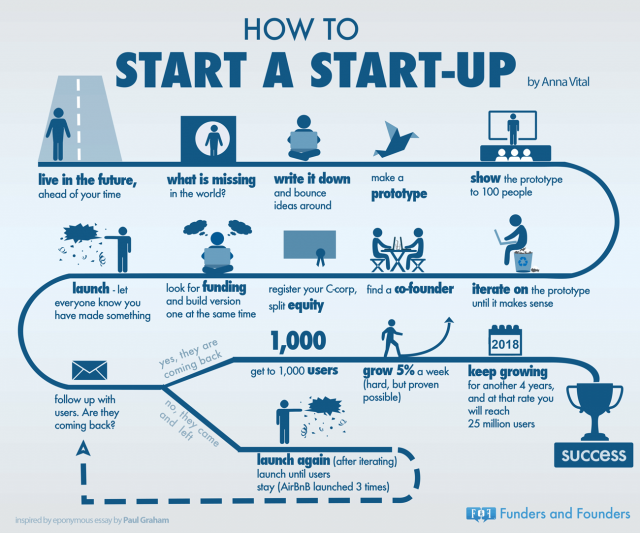

Today, we’ll talk about a different way of scaling your dating business – getting funded by investors.

Attracting investment in a startup (hereinafter, we consider a new online dating business as a startup) is not an easy task. A great way to enter into a dialogue with a potential investor is to ask for advice, evaluation of a startup or recommendation to people who might be interested in cooperation. Every year, investors fund millions of dollars in startups. Last year, they invested $ 122 billion in 8,000+ projects.

Every startup wants to be trusted in and to receive invested. Someone has this fateful meeting and ends with successful cooperation, while someone misses their chance. In this article we’ll look into the basics you need to know about investors?

Where people find investors?

The easiest way to search for investors is through the Internet: social networks like LinkedIn, and information platforms as CrunchBase or AngelList. Here you can meet potential investors in absentia: check their profiles, collect necessary email addresses of people that work in big companies as Apple, Facebook, Airbnb.

Another way is to look into the reports about what companies invested in startups recently and write to their representatives.

There is also a great way to enter into a dialogue with a potential investor by asking for their advice, a startup assessment or recommendation. Don’t directly ask about money: if a person wants to invest, they will offer it themselves.

6 aspects investors look at

Here are 6 basic aspects of a startup that investors look at:

Team

Key questions to the team:

- Does the team have expertise and experience in business?

- Does the team have enough competencies to work on the product that it creates?

Detailed answers to these questions are important when the project uses sophisticated technology.

Customer pain

Customers are motivated to buying a product or service to find a solution to their problem. A product or service should make life easier for consumers: save their money or save time.

Such a startup has prospects to be in demand.

Solution

The solution is how you help your clients deal with their pain. Key factors:

- how cool (read “tech”) solution

- how convenient it is to use.

Here a lot depends on the team. Precisely, your ability to talk about the product in a very simple and clear way, focusing on what has been done in reality, and how it fixes users’ pains.

The presentation about far-reaching plans, dreams that would come true in a few years, will not impress the investor. The decision should be ready or can be implemented fast enough so that you can predict the economy and the start of sales.

Market

Is there a market and niche for your solution at all? If so, how big is it?

When a project is the only one for the entire market, then how expensive it will be to create this market and whether there is a need for it to appear. I.e “No market, no money.”

If the market already exists and there are big players on it, then it’s a plus and it confirms that there is still a demand for the product.

Business model

Having examined the product, team, and market, business investors switch their attention to your business model to understand how a startup is going to earn.

You’ll need to think through what will happen when the product is created: how much it will cost, where and how to sell. The unit-economics must converge.

Trends

There are always trends in investments are, like in show business.

Yesterday it was messengers, today – Artificial Intelligence, tomorrow there will be human-like robots, for example, and the day after tomorrow – something else.

Trends need to be followed because such markets will have more liquidity. This means that the company will be easier to raise the next rounds and get much more attention in the market.